What Do Digital Patients Really Want?

Online Pharmacies Have to Adapt to New Customer NeedsWould you like to read the White Paper offline?

Download as PDFIntroduction

“Even taxi drivers are further along than pharmacists” – This striking statement from digitization expert Christoph Keese, Managing Partner at Axel Springer hy, makes the level of digitization in the pharmacy industry pretty clear.

In Europe, catchwords such as “digital transformation” and “multi-channel” still seem to be foreign words for many brick-and-mortar pharmacies and pharmacists. They argue that their pharmaceutical expertise trumps online consulting and online price comparisons. But it is precisely this attitude that makes the offline pharmaceutical market so vulnerable to new online competitors in today’s day and age.

Drugs are generally not consumer goods. People instead make specific purchases when there is a need. Understand and explaining the need presents an opportunity for suppliers to gain customer loyalty not just through the sale but over the long term and provide ongoing support by offering them additional added value. For example online recommendations of drug therapy with a personal goal or personal consultation.

What are the real future needs of customers? What concrete strategic and technological options are there, and which new laws are reshuffling the cards? We want to answer these questions in This white paper will address these questions and best practice cases with industry experts.

The Current Situation

For 20 years now, consumers in Europe have been able to order their medicines online and have them delivered to their homes. However, the industry still lacks genuine innovative courage.

At the turn of the millennium e-commerce with medicines was still prohibited in most European countries. DocMorris was the first to serve customers this way online from the Netherlands. In this respect, the mail-order pharmaceutical business was originally a cross-border idea, the practical aspects of which were shaped by the EUGH (European Court of Justice) in various rulings against mail-order prescription drugs thus making it a kind of European business model for drugs.

In 2004, mail-order pharmacies were allowed to open online shops throughout Europe and t sell over-the-counter products (OTC) directly. As the OTC price regulations were eliminated, competition and price pressures increased enormously. Pricing search engines and Amazon put great pressure on online pharmacies as with many other e-commerce industries. The big difference is that the pharmaceutical mail-order business had a harder time adjusting because there were still tight legal requirements compared to other e-commerce industries. In addition to the EUGH rulings, there were also other hindrances to digitization such as the strong headwind from within the EU, for example from pharmacists’ associations.

The pharmaceutical market is undergoing a very dynamic development. Stakeholders such as manufacturers, mail-order pharmacies, and brick-and-mortar pharmacies have to respond more quickly to the new, digital needs of customers. Only providers who have the courage to use technology can position themselves digitally to reach customers in the future.

The Game Changer: E-prescriptions

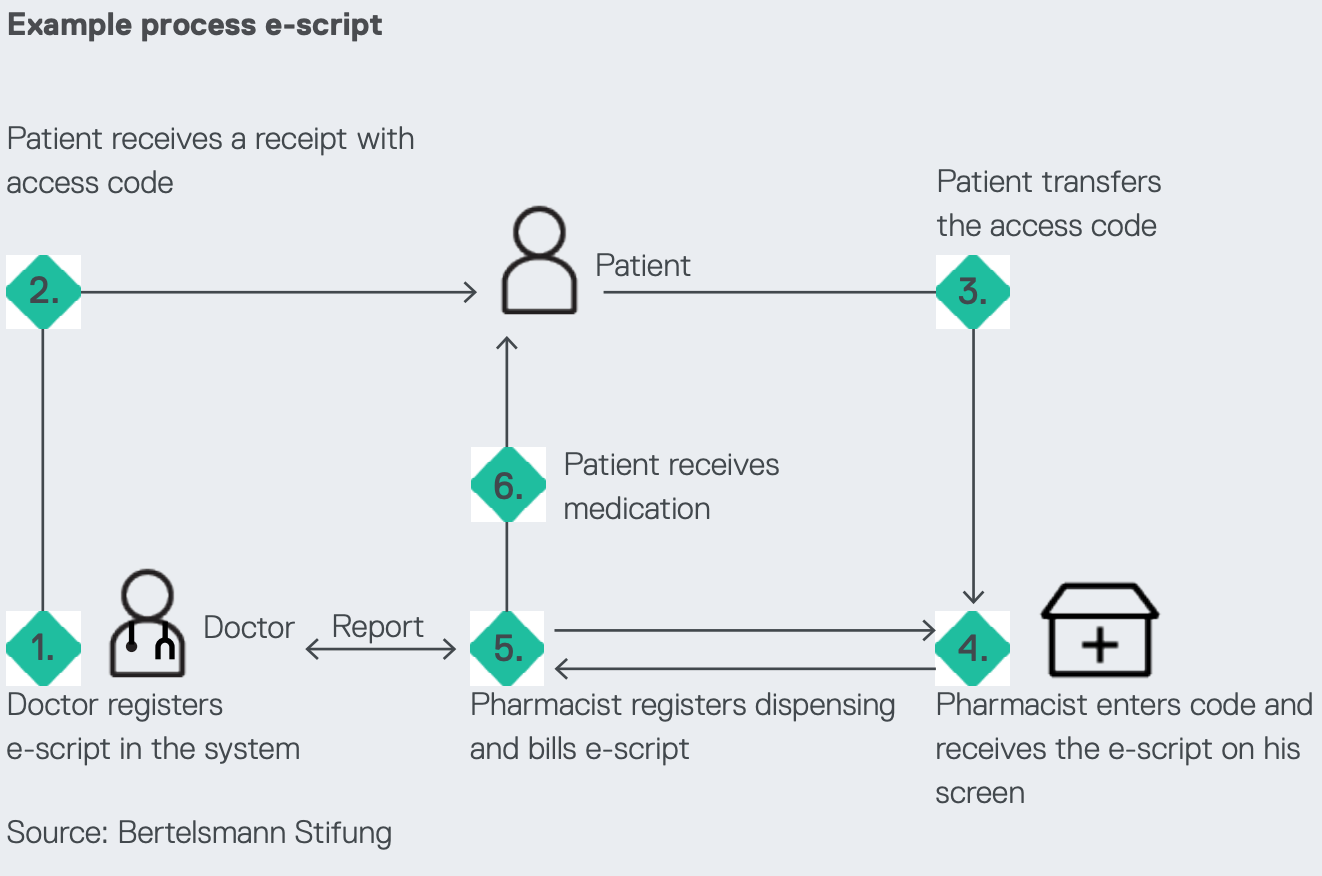

An e-prescription can be issued by the doctor and sent digitally to a pharmacy throughout Europe and across borders. In that sense, it is just the digital version of the prescriptions with which we are already all familiar. Digitization is advancing at a rapid pace in the health sector. Digital prescriptions are intended to optimize the flow of information between doctor, patient, and health insurer and, in the future, enable patients to simply fill a prescription for drugs at the pharmacy or online with their smartphone.

Are There Existing E-prescription Use Cases?

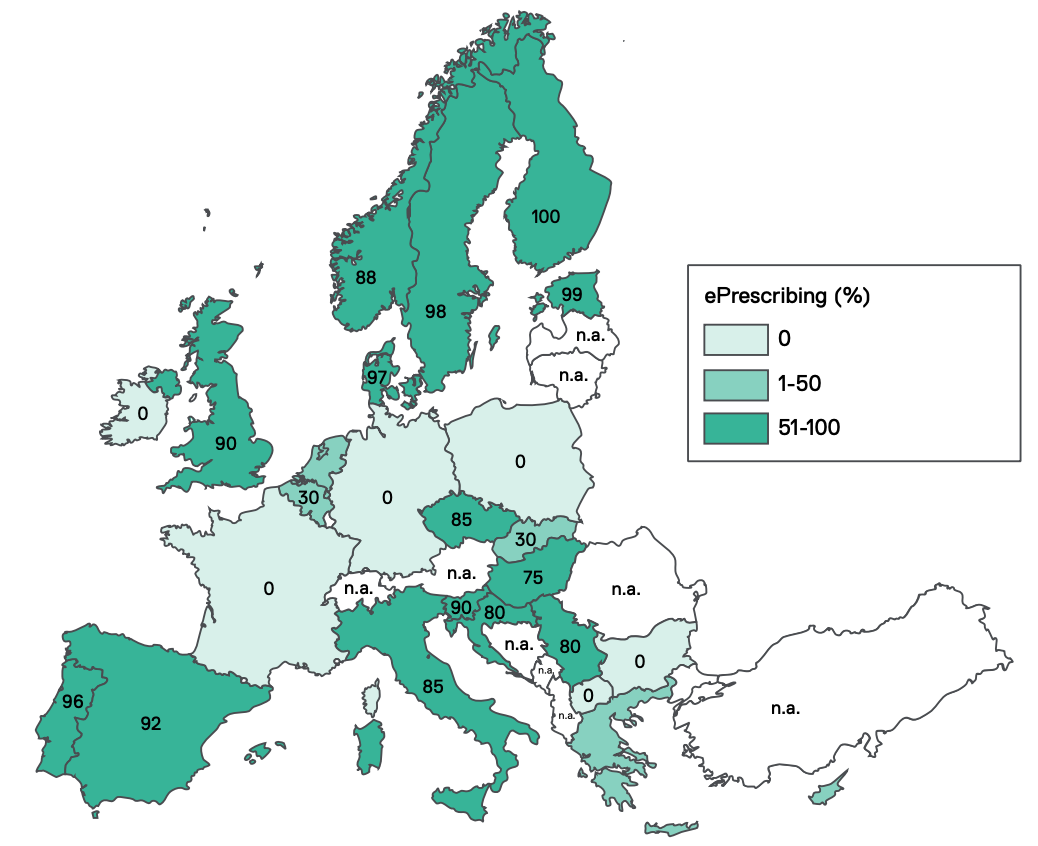

E-prescriptions are already being used successfully in 13 European countries. A look at Scandinavia, France, and Great Britain shows how mail-order pharmacies and customers can already benefit from the integrated offer of remote medical diagnosis via online doctors and the transmission of electronic prescriptions. The extended service portfolio of UK pharmacies is more than just a trend. This model will become established internationally, driven by new legislation and exceptional health situations throughout the world.

An analysis by the European Commission on the state of health care in the EU shows that e-prescriptions are already a living reality in Northern and Southern Europe in particular. The front-runner is Finland, where all drug prescriptions are now being processed digitally. Everything is already managed via a smartphone app there.

Advantages of E-prescriptions from the Customer’s Point of View Which Are Already Redefining the Standard for Every Pharmacy

- Convenience - ordering can be done conveniently online instead of going to the pharmacy

- Speed - ordering and delivery processes are considerably shortened

- Flexibility - opening hours no longer matter

Especially during crises such as the COVID-19 pandemic, it is not always possible for people to visit the doctor or pharmacy. In situations like these, E-prescriptions woiuld be a solution for doctors, patients, and pharmacies.

The model of telemedical consultations and online medication orders is becoming increasingly important for many doctors and patients, especially under these circumstances. Patients communicate with the doctor via video chat in such online consultations. And those who visit an online doctor who issues an e-prescription are usually very willing to obtain their medication online later.

The pandemic is currently providing a boost to telemedicine even in countries where this possibility has so far tended to remain unused: Operators of medical platforms are experiencing a very high demand for such programs in the context of the COVID 19 pandemic. One thing that should not be overlooked here is that the current crisis also brings with it some advantages for the digitization of the health-care system. It is also a solution to compensate for the lack of doctors in rural areas.

The willingness of patients to make use of such virtual consultations also increases significantly during a pandemic. A survey conducted by the digital association Bitkom in March 2020 shows that around 70 percent of those surveyed say that doctors should offer online consultations to reduce the risk of infection in doctors’ offices. In the spring of 2019, only 30 percent said they were willing to take advantage of online consultation.

Technological Requirements

The processing of e-prescriptions requires a technology whose processes and possibilities can be expanded flexibly and adapted at any time to new legal requirements as well as customer needs. This helps companies move forward, ensures their competitiveness, and gives them the opportunity to adapt in an ideal way to new market conditions. To do this, companies need a software solution that can easily integrate and connect new features and channels.

To keep a wide variety of products with all their features and changing inventory numbers updated effortlessly and to be prepared for any traffic peaks, such as during the COVID-19 pandemic, a platform must perform at a high performance level At peak times, such as the current crisis, has already caused many pharmaceutical operators’ servers to collapse. On the other hand, providers who have put themselves in a technological position to withstand even large online traffic storms report sales growth of a full 40 percent during the quarantine period in spring 2020

What Are the Specific Requirements of Online Customers?

Online pharmacies offer great potential to meet customer needs better and more sustainably in the future. But how are customers currently being reached, and how will they be reached in the future?And, above all, how can this lead to a sustainable relationship for both pharmacies and customers?

The Core Topic for Online Pharmacies: Simple and Automated Prescription Management

Processes and procedures need to be mapped in a user-friendly and uncomplicated way in the user interface for customers, i.e., the front-end. And the logic and rules behind this have to be triggered automatically in the back-end. For example, customers with valid prescriptions can make their purchase while expired or invalid prescriptions are flagged.

Customer-friendly Search for Specific Information on Product Components and Side Effects

With medicines, it is particularly important that the product’s information, its ingredients, and side effects are made easily accessible to the customer. Therefore, it is imperative to implement a comprehensive search engine, such as Elasticsearch, with features such as full-text search, auto-fill, and auto-complete. This enables Google-like searches based on the company’s own website – a standard to which many users are accustomed.

Convenience Creates Loyalty

With medicines, it is particularly important that the product’s information, its ingredients, and side effects are made easily accessible to the customer. Therefore, it is imperative to implement a comprehensive search engine, such as Elasticsearch, with features such as full-text search, auto-fill, and auto-complete. This enables Google-like searches based on the company’s own website – a standard to which many users are accustomed.

Use Cases: The Approaches Taken by Market Leaders

The current leading mail-order pharmacies have been active in the European market since the beginning of the mail-order business. Being a pioneer and thinking innovatively as a pharmacy are still essential characteristics for successful brands among the top mail-order pharmacies today. DocMorris was the first provider to send medicines by mail in 2000, and its pioneering work paved the way for the pharmaceutical mail-order business. The two mail-order pharmacies below have established their leading position in various European markets using different approaches.

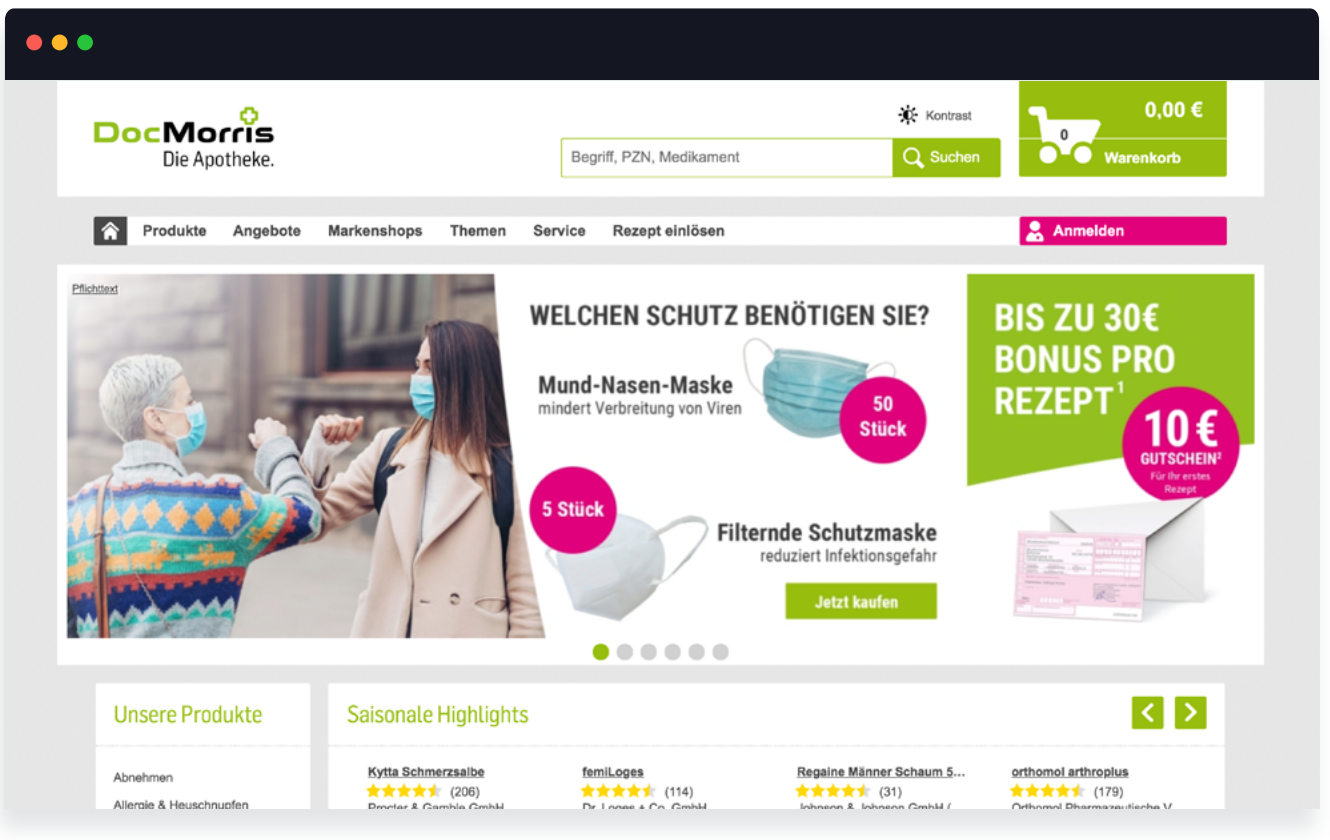

DocMorris: The pioneer in Online Pharmacies

DocMorris has been shipping medicines beyond the Dutch borders since 2000. What began as a small start-up with a few employees is now the largest mail-order pharmacy in Europe, with almost all sales being generated in Germany.

A key success factor for the company was the courage to stand up for the innovative DocMorris pharmacy model against the European Court of Justice despite the considerable resistance of the pharmacy lobby. The EUGH rulings from 2003 and 2016 are significant in this respect and have had an impact on the entire pharmaceutical mail-order business.

How DocMorris Gained a Competitive Advantage

With the EUGH ruling on prescription bonuses in 2016, the Dutch mail-order company DocMorris was allowed, unlike many local suppliers, to advertise prices for prescriptions and scale its prescription orders. DocMorris reimburses 50 percent of the statutory co-payment to the customer, which amounts to a maximum of 15 euros per prescription per customer. The bonus is paid out of the company’s own margin, but the earnings effects are still significantly higher than in the OTC business.

With their regular prescription drug requirements, patients with chronic illnesses, in particular, form the central customer group for the DocMorris business model. The Rx business in Germany accounts for almost 70 percent of total sales. In this respect, DocMorris‘ leading market position is achieved through sales of Rx products.

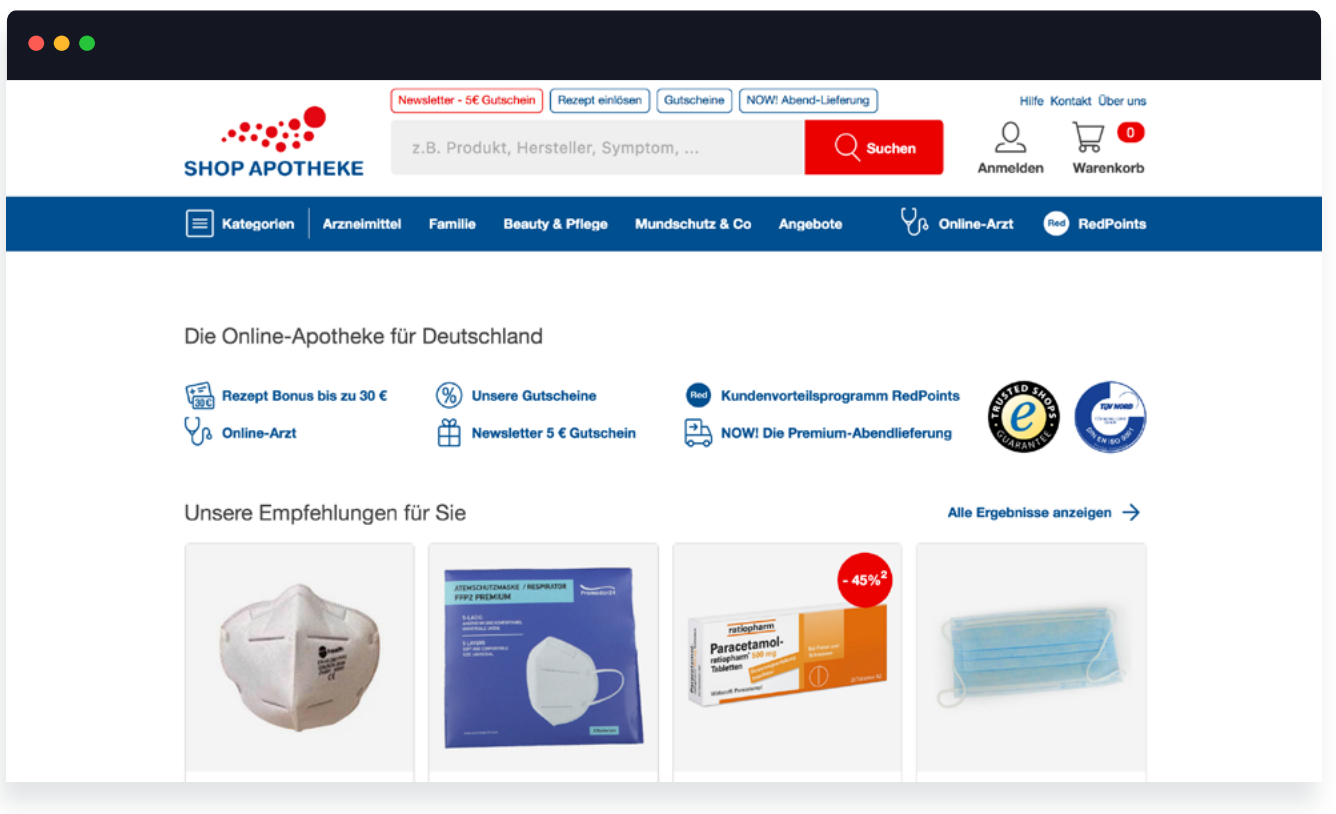

Shop Apotheke: The OTC Winner

Since the start of the OTC mail-order business in 2004, Shop Apotheke has been one of the market leaders. The business model consists primarily of sending over-the-counter medicines, making Shop Apotheke the largest mail-order company in Europe in the OTC product group. After various changes, Shop Apotheke now has its headquarters in the Netherlands after the takeover of the former parent company, Europa Apotheek. It is the second-largest winner, alongside DocMorris, in light of the prescription bonus ruling by the ECJ. The share of prescription business at Shop Apotheke is around 25 percent, which is significantly lower than that of their Dutch colleagues at DocMorris.

Shop Apotheke also offers prescription customers a bonus of up to 15 euros per prescription. The two Dutch mail-order companies share the forecast annual growth of 20 percent in the prescription business alone as a result.3 Since 2016, Shop Apotheke has also been listed on the stock exchange and can initiate its European expansion strategy with the relevant capital.

Broad Product Range and Cross-channel Trade

The key feature of Shop Apotheke is the expansion of its consistent OTC strategy in Europe. The Shop Apotheke brand is already active in six European countries and supplies customers in Germany, Switzerland, Austria, the Netherlands, France, and Belgium.4 Due to its early entry into the market in these countries via its own shops and pharmacy acquisitions, as well as expansion into other countries, Shop Apotheke already has a broad positioning to build up a leading pharmacy brand throughout Europe beyond its German business.

Market Shares are Being Redistributed

The Dutch online pharmacies have been able to establish themselves as pioneers due to the legal requirements of the last decades. However, this competitive inequality with European mail-order pharmacies will change in the near future. The prescription mail-order business is also expected to be liberalized in other EU-countries and made easily accessible to customers with an e-prescription. That means the Dutch will see competition from other European companies. As a result, market shares are being redistributed. Those who are already technologically capable of meeting the new requirements will benefit.

Where will the pharmaceutical market be in the next 10 years?

Some major development axes are already evident: On the one hand, the classic mail-order pharmacy business is slowly emerging from its adolescence in terms of professionalization and maturity. The mail-order market is moving at very different speeds, which is leading to consolidation. If we look at 10-20 mail-order companies, we can see that the top 3 are much more dynamic than other mail-order companies – quantitatively and qualitatively. Fast companies and big companies are increasingly dominating the market. This can be seen, in particular, at DocMorris and Shop Apotheke, which have a strong capital base due to their IPOs and invest massively.

Their takeover activities during recent years are a good example of this, such as the acquisitions of Eurapon and Vitalsana by DocMorris. The funds are available there to buy additional market shares. One thing is clear: The consolidation process is accelerating. In addition to the acquisition of competitors, the focus is on investments in further growth, i.e. marketing, international expansion, and the expansion of IT and supply chain structures. This development naturally makes the top players among mail-order pharmacy retailers interesting for the industry, which is increasingly providing budgets for conditions and marketing activities. This will further accelerate the process of consolidation and professionalization.

Can you imagine how Amazon will play a role in the future pharmaceutical sector market?

As Amazon continues to enter the market, the industry will receive another significant boost as it already has a vast customer base. Amazon will continue to introduce customers who have not previously used online pharmacies to categories such as health products, medicines, and dietary supplements. Today, Amazon is the “vehicle” for marketplace pharmacists. We all know that you have to be a pharmacist to run a pharmacy in Germany – unless Amazon finds a legal construct, for example, via a registered office in Holland. In this case, Amazon could also operate directly as an online pharmacy and put other mail-order companies under massive pressure. Amazon is a world champion in the development of mechanisms for customer retention and intensification. Of course, all mail-order companies respect Amazon now – and rightly so. We know what happens when Amazon enters any market: a massive displacement takes place.

What do pharmacies need to be able to do in the future?

The introduction of e-prescriptions means that the treatment of patients via telemedicine will become increasingly possible. Regarding the role mail-order pharmacies will take: The core of the business model is the inexpensive and nationwide provision of products. Price is one of the main motivators for why consumers buy products online. This is especially true in the OTC sector and particularly when buying highpriced products or even potentially embarrassing products such as hair restorers. Ordering online can help customers avoid a possibly unpleasant shopping experience in a brick-andmortar pharmacy.

The function of mail order is to stay relatively close to the customer via the touchpoints. But the smartphone interface massively simplifies purchasing processes. Added to this is the possibility of tailoring offers to the customer. Classically, this is done via recommendations and evaluations.

A third area that is already emerging as a trend in my view is voice devices. What role will this play when it also becomes possible to order medicines or food supplements via Amazon’s Alexa? This is a very exciting prospect for the future – for pharmacists as well. Consumers are not yet aware of the added value they can derive from interaction with voice devices, and things will eventually move beyond the funny dialogs with Alexa in the near future. The underlying artificial intelligence and machine learning will bring real added value for customers and patients, especially at the service level, which is crucial in the pharmaceutical sector.

Are there major players who could enter this market in the next ten years?

Germany and Great Britain are the most developed markets in terms of mail-order pharmacies. The UK market has, of course, the peculiarity of having a dominant and highly professional player in Boots, which operates both online and offline and is closely linked to the National Health Service (NHS). In other European countries, however, the course is also already being set. Shop Apotheke is currently making a strong commitment in France under the name “shop-pharmacie.” Another example is Austria. The topic of mail-order pharmacies is growing there despite a strong pharmacist lobby. That is because Austrian consumers are already placing orders with German, Dutch, and Czech mail-order companies. There is a lot of movement in the European markets right now and, indeed, a lot more will happen there.

As the decision-maker for a large European mail-order pharmacy, what do I have to do strategically today so that I will still be the market leader in ten years?

First, I have to generate growth – whether it is through a wide range of products, attractive prices, fast and reliable deliveries, or customer-loyalty measures tailored to the customer across all touchpoints. This applies at both the national and international level. This is work that does not happen by itself and requires high investments. Then, as a mail-order company, I can increase the depth of added value, e.g., through private labels and D2C strategies. I also need to invest in technology: Machine learning and artificial intelligence will also become important tools to understand the customer better.

Do you think that the manufacturers themselves will penetrate this market more strongly?

In the classic OTC sector, there is a high dependency on the pharmacy channel – even outside of the drugs that can only be distributed by a pharmacy. A go-to-market strategy in this sector other than via the pharmacy is ambitious and represents a high risk. Is it worthwhile to market the product directly in order to take away a margin that the retailer would otherwise have? How high are the expected losses if the pharmacist resists this? Let’s assume that I market the “Orthomol” product range directly via an Orthomol platform instead of via the pharmacy – I think that would massively endanger the brand’s pharmacy sales.

How important is customer data in this business?

Extremely important. One prominent example that allows a glimpse into the future is Verily, the Alphabet (Google) subsidiary in the life-science sector. Massive investments are currently being made there. They say Google mapped the internet – and now that they are done with that, they are going to map the human body, together with leading health care companies and universities. For example, contact lenses that can measure the blood sugar level of people with diabetes via tears are currently under development. And similar topics are also being worked on, all of which link health to the digital levels. The aim is to identify, prevent, or treat health problems intelligently and based on data in a timely way. The database required for this goes far beyond traditional customer data.

What changes will take place in the supply of medicines in Europe over the next ten years?

Medical and technological progress, changing lifestyles, demographic change, financial constraints, and, above all, digitization have led and will continue to lead to fundamental changes in the health-care system. Both key players and service providers in the health-care market must develop sustainable business models to be able to provide optimal care for patients.

What are the three most important factors influencing the “digital pharmacy” business model?

The EU Commission recognized early on that high-quality, efficient health care close to home requires a focus on the needs of those affected and their active participation today more than ever before. Informed patients interact with their doctors today at the level of equals in a sense. Therefore, a high-quality care system requires the rapid transfer of scientific knowledge and innovations. In the context of the rapidly advancing digitization of industry and society, the networking and integration of health-related data in the health-care system will play a central role in the future. We assume that e-health applications, platform solutions, and digital medication management will be central elements in the future health-care system in the future.

Which factors are inhibiting the further development of digital medication sales?

The example of Sweden shows what a successful digital evolution could look like. It is known for its liberality, pro-social attitude, and open-mindedness and ranks third in the digitization index. This proves that it is possible to carry out digitization in a humane, philanthropic, and pro-social way without neglecting the principles of progress. An important factor in Germany is that in the age of digitization, we need new political framework conditions and the corresponding courage of all service providers in the health-care system. Digitization is unstoppable in the healthcare system, as well, but it has to serve the people to create real added value.

What are your views on the recent e-prescription debate and what would its introduction mean for your prescription business model?

It is a shame that in the age of online banking and online shopping, we still have to discuss the introduction of e-prescriptions. Society has long been networked through modern means of communication, and patients have wanted and needed e-prescriptions for years. E-prescriptions will play an important role in the imminent lifting of the ban on remote treatment by doctors. Of course, the introduction will significantly simplify the process of ordering prescription drugs for patients and will greatly reduce the time needed to deliver the drugs.

What are the needs of these new digital customers?

There needs to be more transparency about the sovereign patient who has control of their own data, assuming data protection regulations. It is the driver for digital progress. The desire for individual quality of life, whether in the countryside or the city, has also increased significantly – in the healthcare system as well. With the help of apps and digital networking, patients put their lives and health in focus and rightly expect all players in politics to do justice to their life situation.

How does the service component of brickand-mortar pharmacies take place online, and what other developments will follow?

Patient-specific digital pharmaceutical services are becoming increasingly important in pharmacies. DocMorris is setting new standards in this area with its entry into the telepharmacy sector in cooperation with Deutsche Telekom: The web-based live consultation by DocMorris pharmacists and pharmaceutical technical assistants complements consultations via chat, telephone, or e-mail. The customer is advised in real-time on all questions relating to their individual drug therapy – with professionally sound information, discreetly, and when and where they want it.

With its Mobile Pharmacy App, DocMorris offers the respective user services and information based on their medication data, which has not been available to them in a meaningful and intelligently networked way in the healthcare market. The coordination of data and tools, together with easy and intuitive usability, is moving the pharmacy system to the next evolutionary stage. The Mobile Pharmacy App is a constant companion that patients always have at hand – with functions for drug therapy safety, such as an interaction check based on real-time data, for therapy compliance and for consultation.

Digitization has the power to change everything. And it is not just about the discussions of “old versus new” or “brick-and-mortar pharmacies versus online pharmacies,” but about participating in a development that cannot be stopped. Digital platforms make it possible to link collected health data, such as pulse and diabetes values, with data from the professional medical sector. This combination is what will enable advanced approaches for individual therapies tailored to the individual patient.

Forecast

Despite dynamic market changes, the pharmacy’s job will stay the same – namely to ensure the safe and rapid supply of medicines to people. The digitized society with new customer needs and the availability of innovative interfaces such as chatbots will generate greater competitive, cost, and innovation pressure for pharmacies, both online and offline.

Increased Care Performance

Mail-order retail with pharmaceuticals can play a connecting and social role, e.g., in securing healthcare for rural populations. Helping people where they are is one of the central requirements for how health services should be oriented in the future – that means the digital pharmacy role will be increasingly accepted and wanted by society and politicians, with measurable added health value for the patient.

Increased Competition

When we think about the future of the pharmaceutical market and mail-order business, we can see it will become standard for customers to send prescriptions directly online to their preferred retailer after diagnosis by their online doctor. National borders and national laws will also restrict mail-order business less and less. There will no longer be countless mail-order pharmacies baiting patients with the very best price, and there will instead be a few large players who are already investing today in future requirements and innovations and who do not define their success solely through the sale of prescription or OTC products.

Greater Convenience for the Customer

Health will go beyond the high-performance distribution of pharmaceuticals, and customers and patients will be able to use the pharmacy wherever and whenever. Patients will understand that the pharmacy can help them become healthy or healthier and that they have access to their information at any time – just like with an online bank account. DocMorris and Shop Apotheke are already doing this: Online channels are transforming the mail-order pharmacy business into a health-commerce market with a variety of additions to the current pharmacy concept.

Increased Pressure to Innovate

Health-insurance companies are already rewarding their customers’ compliance and successes with therapies. It is conceivable that in a few years, the “bonus booklet from the dentist” will transform into digital documentation of all health activities. Expertise in handling health-related digital data from customers will be a great opportunity for manufacturers and even more so for the digital pharmacy of tomorrow to add individual added value to today’s pharmacy concept.

Conclusion

It seems that the health industry, especially the pharmacists’ associations, are currently shying away from the topic of digitization like the devil shying away from holy water. However, recent developments are exerting intense pressure on the healthcare market to digitize, and even the staunchest opponents are being forced to address the issue.

The diverse market in Europe has long been a hindrance to the expansion of the mail-order pharmacy business model. Restrictive policies prevented any ability to plan out this business model in the prescription segment. But things are changing now. E-prescriptions have already been introduced in 17 European countries, and it is predictable that liberalization and harmonization will also take place in this segment. The restrictive prescription policies will be relaxed gradually as the introduction of e-prescriptions will significantly simplify the mail-order business for medicines.

Customer requirements are no longer limited to good advice. The digital pharmacy customer expects the following above all: a high degree of convenience, intuitive and quick searches for products and information, 24/7 service, and simple prescription management.

Providers who are preparing technologically today for new freedoms in retail can gain future-proof technology and a high level of digital maturity within a few weeks. Industry experts predict that in 10 years there will only be a small number of mail-order pharmacies positioned throughout Europe as health partners for patients. Be one of them!

About Spryker

Spryker is the leading global composable commerce platform for enterprises with sophisticated business models to enable growth, innovation, and differentiation. Designed specifically for sophisticated transactional businesses, Spryker’s easy-to-use, headless, API-first model offers a best-of-breed approach that provides businesses the flexibility to adapt, scale, and quickly go to market while facilitating faster time-to-value throughout their digital transformation journey. As a global platform leader for B2B and B2C Enterprise Marketplaces, IoT Commerce, and Unified Commerce, Spryker has empowered 150+ global enterprise customers worldwide and is trusted by brands such as ALDI, Siemens, ZF Friedrichshafen, and Ricoh. Spryker is a privately held technology company headquartered in Berlin and New York backed by world class investors such as TCV, One Peak, Project A, Cherry Ventures, and Maverick Capital. Learn more at spryker.com.